How to Set Financial Goals

Prioritizing how you spend your money is a crucial part of achieving a secure future. The first step in how to set financial goals is deciding how much money you want to make and how quickly you can meet those goals.

If your goal is to be financially independent, for example, then the answer will depend on how long it takes for that independence. Some people may only need 10 years while others might need 30 or more years before they have enough savings to retire from their jobs at age 65.

You can set your goals for how much money you would like to make and how quickly it should happen. You also need to decide how much of your income will go towards savings and how much will go towards paying off any debts you have.

What are financial goals?

Financial goals are personal targets to aim for when managing your finances, usually determined by specific future financial requirements. They can involve saving for big purchases or investing, diversifying your income streams, developing a debt repayment plan, or spending.

Financial goals can be targets to aim for in the short-term or further down the road. Having rock-solid personal financial goals is a crucial step toward financial security as it gives you a clear roadmap for realizing those goals.

When you have clearly defined targets to achieve, it becomes easy to stay on track. Also, it gives you an opportunity to review your goals from time to time, update them, and determine your progress. If you aren’t working toward specific financial goals, you’re likely to overspend and fall into debt.

Types of financial goals

• Short-term financial goals– These are smaller financial targets that can be achieved in one year or less. Examples of short-term monetary goals include saving $500 for a vacation, buying a new entertainment system, or paying a small debt. Like any other goal in life, these goals should be time-bound.

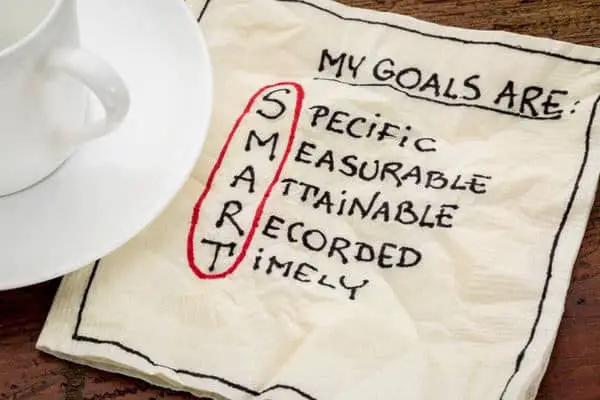

• Medium-term financial goals – These are goals that can be realized between one year and five years. For example, paying off credit card balance or saving for a down payment on a new family car. To achieve your midterm financial goals, you must apply SMART planning strategies.

• Long-term financial goals – These goals take more than five years to achieve. Examples of long-term financial goals include saving for college, saving for retirement, or paying off your student loan.

Related: A Comprehensive Financial Planning Process in 6 Steps

Financial Goals List and Examples

Most people fail to secure their financial futures simply because they do not have financial targets to aim for. Setting rock solid financial goals requires you to think about what matters to you. Whether your goal is to save for investment to put your finances in order, the following list of financial goals can help you get started.

1. Make a budget

Creating a realistic budget and sticking to it is the first step toward attaining your rock-solid personal financial goals. It allows you to gain control over your finances. Besides, it helps you to avoid spending unnecessarily on things that do not help you to achieve your goals, track your progress and realize when you need to adjust your goals to suit your changing financial situation.

2. Save for retirement

Saving for retirement is one of the most important financial goals you’ll ever have as it will ensure you have enough money to live comfortably when you stop working. You can set up a 401 (k) or utilize any other effective retirement plan to save for retirement.

3. Save for your children’s education

One of the biggest financial concerns for parents is paying for their children’s education right from elementary school to college. It’s important to utilize the best financial plans for children’s education to avoid huge financial burdens down the road.

4. Saving for a vacation

You don’t have to go into debt to enjoy your dream vacation. The secret is to set aside enough money for your planned vacation.

5. Build an emergency fund

Money-saving goals won’t mean anything unless you set aside funds for a rainy day. Life is unpredictable, and emergencies like job loss, medical expenses, and accidents can quickly put you in debt. Having an emergency fund cushions you from emergencies.

6. Pay off high-interest debts like credit cards or loans

It’s a fact that high interest rates make it hard to pay off credit card debt and loans. So it’s advisable to get rid of high-interest debts first and save more money.

7. Start a business

One of the financial goals you should prioritize is starting a business and diversifying your income streams. Along with allowing you to achieve the financial independence that you need, a business gives you more freedom and flexibility.

8. Develop and improve skills to earn more income

The best way to achieve your financial goals is to increase your earning potential. So be sure to build high-income skills and keep improving on them to stay ahead of the pack. Some of the best skills you can learn under a year include computer programming, a second language, online marketing, and many more.

9. Secure enough insurance

Insurance serves as a safety net for uncertainties in life and business. Having enough insurance allows you to handle emergencies, transfer financial risks, and ensures you live a tension-free life. Therefore, one of your financial goals should be securing enough insurance from life insurance to mortgage insurance and social insurance.

10. Start a side hustle

A side hustle will bring in extra income for spending or saving for the future. Some of the side hustles you can consider earning more income outside of your 9 to 5 job include freelance writing, babysitting, working as a virtual assistant, and digital marketing.

11. Financial security

Being financially secure is one of the financial goals that can take most of your life, so it makes sense to start right now and stay focused. To achieve financial security, you must save more, invest wisely, and create additional sources of income.

12. Start investing regularly

Investing is an effective way to increase your financial worth and attain financial security. You must invest your money in things that bring in high returns such as stocks, mutual funds, and bonds.

13. Save for down payment for a home or pay off mortgage sooner

Homeownership is a prudent long-term financial goal you should aim for. Saving up a substantial down payment for a home can help you get a home loan and avoid the cost of Private Mortgage Insurance.

14. Improve your credit score

One of the items you’ll find on most people’s list of financial goals is improving credit score. The higher your credit score, the more likely you are to qualify for loans at the most favourable terms. While it may take time, it’s not as hard as it may seem.

The first step toward improving your credit score is knowing where you stand and what might be dragging you down. Other steps that can raise your credit score substantially include paying your credit card debt or loans, asking for a limit raise, and correcting any report errors.

Related: A Comprehensive Financial Planning Process in 7 Steps

Why is it important to set financial goals?

Setting financial goals helps you to determine your short-term financial goals as well as midterm and long-term monetary goals. It also enables you to create a balanced plan and achieve prudent spending and budgeting to attain those goals.

With specific goals in mind, it’s easier to prioritize on which goals to accomplish first. It also becomes easy to track your progress and make the necessary adjustments along the way to reflect your current financial situation.

Other benefits of setting financial goals include:

- Helps with retirement planning – Solid long-term financial goals include retirement planning so that you can live a comfortable life after retirement.

- Helps with tax planning – You can establish the amount of money you’re paying in taxes and find ways to reduce tax liability and save more money.

- Helps you to stay focused – With SMART financial goals in mind, you can work consistently towards making them a reality. Instead of wandering aimlessly, you have a specific target to aim for. Initially, create a short-term financial goal as you progress expand it into a long-term financial goal

- Develop good spending and saving habits– Smart financial goals enable you to adopt prudent spending habits so as to save more money for investment, emergencies, and overall financial security.

- Plan ahead for emergencies – Emergency situations can mess up your finances and sink you into debt. Having financial goals helps you to build an emergency fund to cushion you in the event of unexpected expenses.

How to set financial goals

Setting achievable financial goals is an important step toward attaining financial security. Setting goals not only gives you a clear vision and the motivation to attain success but also helps you get organized.

Instead of working without a specific target in mind, you have something to strive for and a roadmap for getting there.

The Following are Six Steps – How to Set Financial Goals.

1. Determine what’s important to you

Setting financial goals comes down to one crucial thing—knowing what matters to you. Whether you want to save enough money to diversify your investment portfolio or you want to start a business and achieve freedom and flexibility.

Knowing what’s truly important to you can help you create a game plan. Moreover, it gives you the motivation to stay focused on something you are passionate about.

2. Establish what’s achievable and timelines

When writing down your financial goals, whether long term or short term, it is important that you determine what’s achievable within realistic timelines. Setting goals you have no hope of attaining is the easiest way to get demoralized, lose track, and erode confidence.

Typically, you might want to give a higher financial priority to short-term goals but still, you must put your medium-term and long-term financial goals in your bigger picture so as not to lose focus.

Most importantly, you’ll have to create a timeline and try to stick to it as closely as possible. A timeline creates a sense of urgency and motivates you to stay on schedule.

3. How to Set Financial Goals – Adopt a SMART goal strategy

Setting SMART goals—Specific, Measurable, Achievable, Realistic, and Timely goals bring clarity and precision to your objectives. Along with providing the motivation, you need to reach your goals, this strategy reduces ambiguity and helps you track your progress using trackable KPIs.

Simply put, your goals should be precise, not impossible to achieve, and have specific criteria for measuring progress.

In order to set SMART goals, start by writing down the specific goals you have in mind. When you can visually see the goal, you’ll have more clarity and direction.

The next step is to categorize your goals into rock-solid personal financial goals, medium-term, and long-term categories, and create a timeline for each goal. With a clearly defined timeline, your goals end up being a wish list of objectives.

An example of a specific and time-bound goal is paying off $5,000 credit card debt in one year. Once you have your specific, realistic, and time-bound goal written down, start thinking of ways to make it a reality.

You can start a side hustle, reduce your expenses, save more money, and adopt other practical strategies to reach that goal. Be sure to document the process to visualize your strategy.

Related: 7 Types of Goals: The Ultimate Guide to Goal Categories

4. How to Set Financial Goals – Develop a budget

Budgeting is an integral part of setting financial goals. Developing a budget and sticking to it allows you to avoid spending unnecessarily on things that are not budgeted for, gives you control over your finances, and allows you to track your progress.

Having a budget can help you determine your financial priorities. When creating a budget, it’s important to consider your net worth (cash, investments, savings, liabilities) so that you can build realistic money-saving goals.

5. Reduce your spending

Developing a budget forces you to evaluate your spending habits and establish where you may be able to cut back. Spending money on things you don’t need derails your money-saving goals, making it harder to reach your financial goals.

Some expenses may seem to be small and insignificant but they can accumulate really fast and become enormous. Therefore it’s important to rethink your spending habits.

Some of the practical ways to cut back on your spending include:

- Eating out less often

- Carpooling to work

- Reducing energy bills

- Ditching cable TV

- Consolidating your debts

- Shop around for best deals

6. Monitor your progress

Tracking your progress helps you to remain focused on reaching your solid personal financial goals. It also gives you a clear idea of your financial position and helps you to tweak your money-saving goals if necessary.

In conclusion to how to set financial goals

Overall, setting personal financial goals is an important step in financial planning or wealth management. Setting financial goals is an important part of how people can take control over their finances. The first step to setting these goals is writing them down and then figuring out how much money you have available for each goal.

Once that’s done, it may be helpful to create a budget so you know how much money will go towards which goal. It also helps to write down specific steps you need to take in order to reach your desired outcome by the deadline.

This way, if something happens or gets derailed along the way. At least there are clear next steps outlined on how progress could resume again. Finally, make sure not only do you stay motivated but also keep track of where your time goes every day.

This will help ensure nothing slips through the cracks and you stay on track with both your goals and how you spend each day.

You may also like the following posts:

- 15 Proven Strategies To Pay Off Your Credit Card Debt Fast

- A Simple Guide to Credit Report vs Credit Score explained

- 8 Simple Tips to Fix Your Credit Score Fast

- Insanely Easy Ways To Get A Free Credit Report

- Drowning In Debt: The Definitive Guide To Debt Management & Paying Debt Off

- How does Consumer Credit Counseling Services Help to Tackle Credit Problems

- The Practical Guide to Purchasing Your First Investment Property

- Renting vs. Buying a House Debate: What’s Best For You?

3 thoughts on “Financial Goals & Objectives – How To Set Financial Goals”

Pingback: Financial Plans 101: What Are They and How Can You Make One? - Investadisor

Pingback: Tips For Couples Becoming Empty Nesters - Investadisor

Pingback: How Much Money is 6-Figures a Year, 7-Figures, 8-Figures, 9-Figures & 10-Figures? - Investadisor